How does a revolving line of credit work?

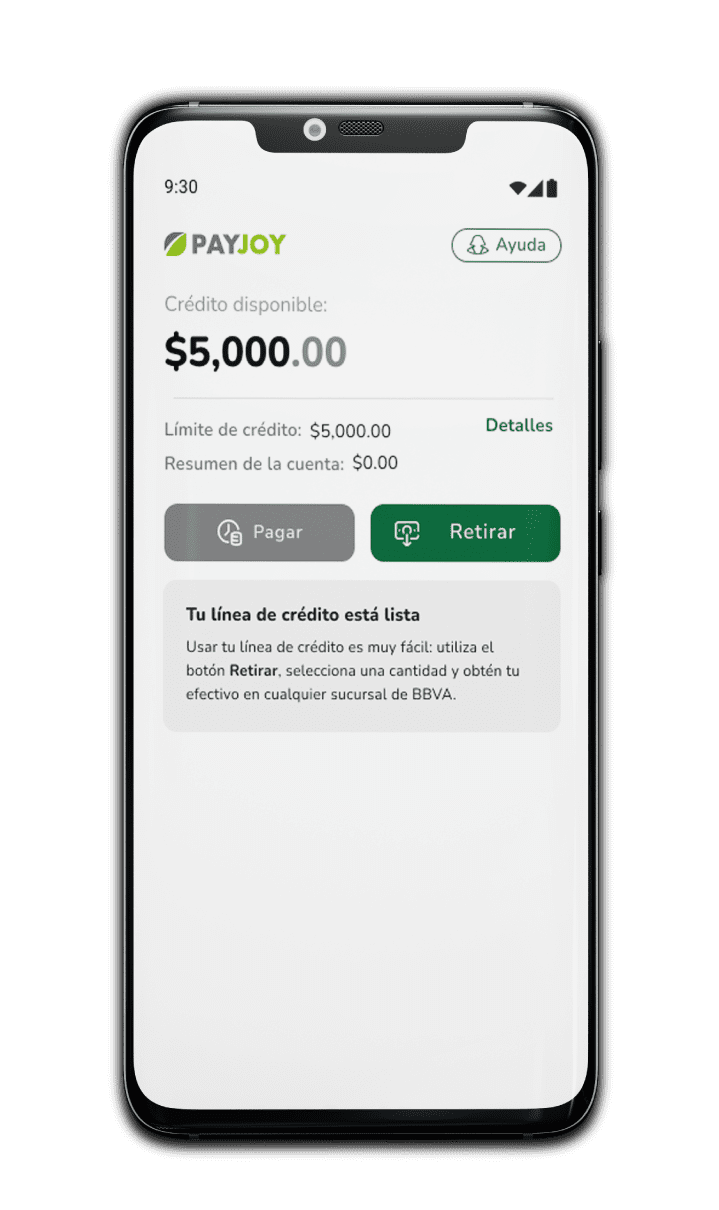

A revolving line of credit consists of having an established amount that you can have at any time that is automatically renewed with each payment. For example, if your line is 1,000 pesos and you used 500 pesos, you will have 500 pesos available, but when you pay the 500 you used, you will have 1,000 available again. If you have any questions, reach out to us.

How can I increase the amount I have available?

Easy! You just need to take advantage of your loan and make your minimum payments on time. If you are consistent, you will receive offers in the future to increase your available cash.

Are there extra charges if I don't use my loan?

No! At PayJoy, you decide how much you withdraw and when you use your money. You do not get charged for the amount you have not used.

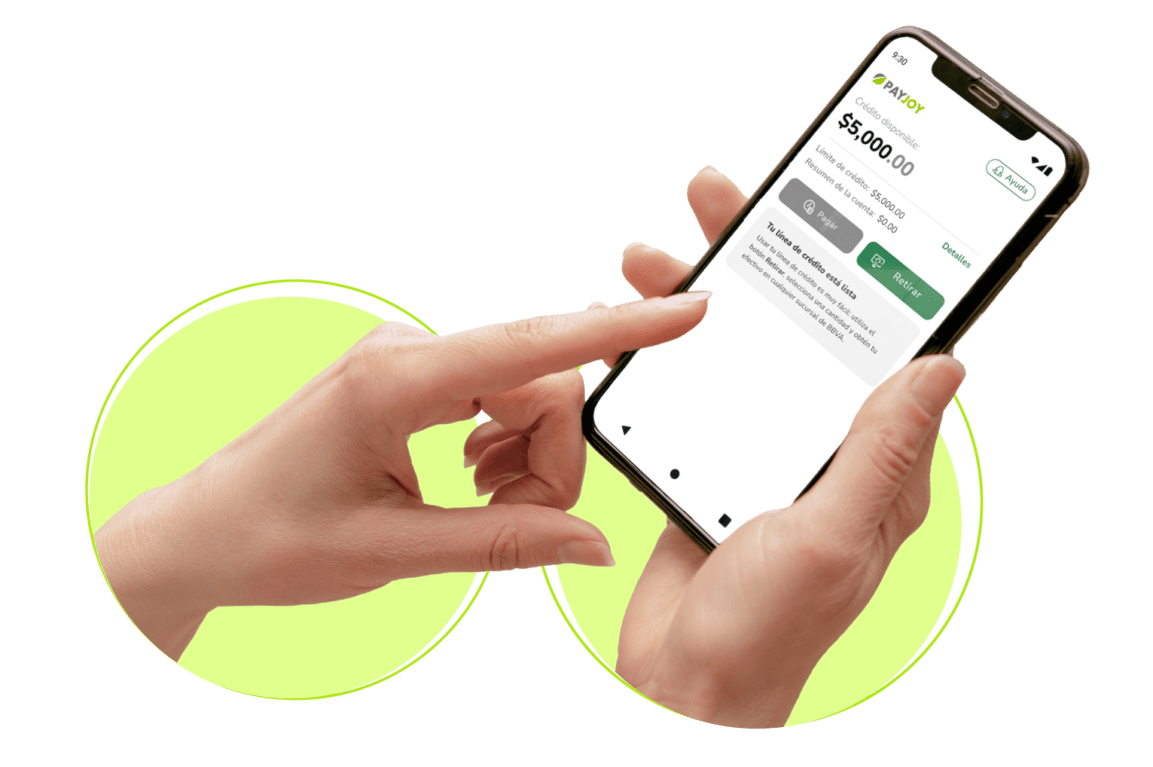

How do I withdraw my money?

To withdraw your money you only have to go to any BBVA branch at the window with your current INE/IFE.

How soon will my withdrawal be available?

Your withdrawal code will appear on the main screen of the PayJoy app within 24 hours.

Can I cancel or modify a withdrawal request?

For security reasons, you cannot cancel or modify your request. You have to wait 7 days, which is the period in which your withdrawal request expires, in order to start a new one.

How much money can I withdraw?

Any amount you want! It can be the total amount available or a part of your available funds. Just remember that the minimum is 100 pesos.

How much do I have to pay for my loan?

This will depend on the amount you withdraw, and we will tell you when you make your request. The good news is that if you pay more than the minimum amount on time, you will save interest.

Where can I make my payments?

You can make your payments in places like OXXO, 7-Eleven, Walmart and Farmacias del Ahorro or by bank transfers. Through the PayJoy app, you can choose the option that suits you best. You will then receive a reference code, which is updated weekly, which you must use when paying.

Can I use the PayJoy Credit Line if I haven't used PayJoy before?

At the moment, PayJoy Credit Line is an exclusive service for PayJoy users. We are working so that, very soon, everyone can have access to our loans.

Do I need a bank account to access the PayJoy Credit Line?

No! You can withdraw at any BBVA bank and you can pay your loan directly at an OXXO or convenience store. You do not need to have a bank account.